The following is an excellent article written by Olga Kharif on the Bloomberg website on February 5, 2018 titled “Bitcoin Tumbles Almost 20% as Crypto Backlash Accelerates” and I quote:

“Bitcoin Tumbles Almost 20% as Crypto Backlash Accelerates”

By-

Lloyds joins U.S. banks in prohibiting purchases with cards

-

Value of the biggest cryptocurrency drops by as much as $1,990

Bitcoin tumbled for a fifth day, dropping below $7,000 for the first time since November and leading other digital tokens lower, as a backlash by banks and government regulators against the speculative frenzy that drove cryptocurrencies to dizzying heights last year picks up steam.

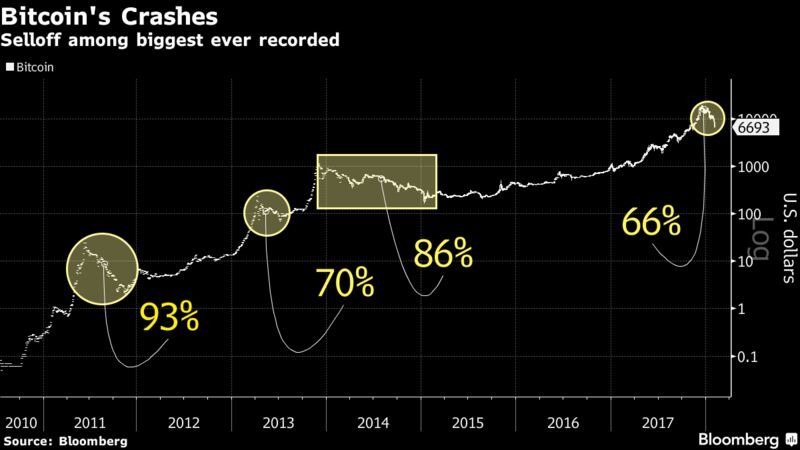

The biggest digital currency sank as much as 22 percent to $6,579, before trading at $7,054 as of 4:08 p.m. in New York, according to composite Bloomberg pricing. It has erased about 65 percent of its value from a record high $19,511 in December. Rival coins also retreated on Monday, with Ripple losing as much as 21 percent and Ethereum and Litecoin also weaker.

“Although no fundamental change triggered this crash, the parabolic growth this market has experienced had to slow down at some point,” Lucas Nuzzi, a senior analyst at Digital Asset Research, wrote in an email. “All that it took this time was a large lot of sell orders.”

Weeks of negative news and commercial setbacks have buffeted digital tokens. Lloyds Banking Group Plc joined a growing number of big credit-card issuers have said they’re halting purchases of cryptocurrencies on their cards, including JPMorgan Chase & Co. and Bank of America Corp. Several cited risk aversion and a desire to protect their customers.

SEC Chairman Jay Clayton said he supports efforts to bring clarity to cryptocurrency issues and that existing rules weren’t designed with such trading in mind, according to prepared remarks for a Senate Banking Committee hearing Tuesday on virtual currencies.

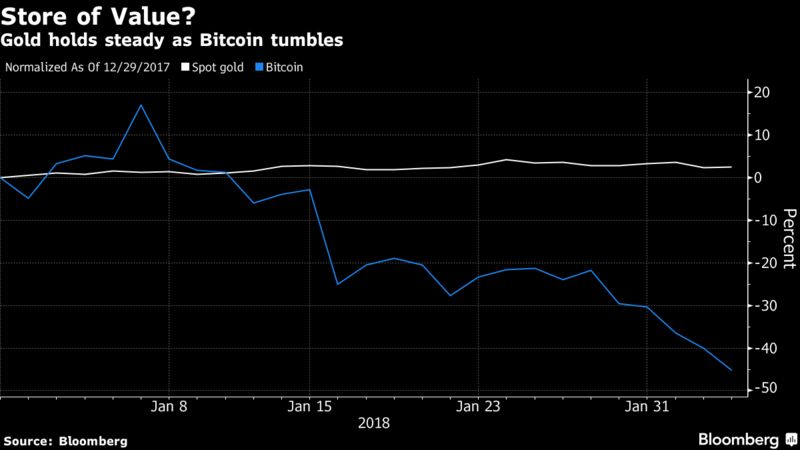

Bitcoin’s longest run of losses since Christmas day has coincided with investors exiting risky assets across the board, with stocks retreatingglobally. Bitcoin so far seems to be struggling to live up to any comparison with gold as a store of value, which is an argument made by some of its supporters. Bullion edged higher as other safe havens — the yen, Swiss franc and bonds — also gained.

For more on cryptocurrencies, check out the Decrypted podcast:

Regulators in what have been some of the hottest market overseas are also seeking to gain more control of trading. China will block all websites, including foreign platforms, related to cryptocurrency trading and initial coin offerings in an attempt to finally stamp out speculation in the market, according to a South China Morning Post report.

Meanwhile, North Korea is trying to hack South Korea’s cryptocurrency-related programs to steal digital currencies and has already stolen tens of billions of won worth, Yonhap News reported. And authorities in digital-coin powerhouse South Korea and other countries are weighing increased regulatory scrutiny of the industry, news which helped spark the ongoing selloff.

Yet some Bitcoin stalwarts remain unconcerned.

“There are a few catalysts: people paying taxes, and general mean reversion,” Kyle Samani, managing partner at crypto hedge fund Multicoin Capital, said in an email. “Overall, this is probably healthy given the run up in November-January.”

— With assistance by Eddie Van Der Walt, and Todd White”

(I’M GLAD TO READ THAT COMMUNIST CHINA IS BLOCKING THE CRYPROCURRENCY MARKET. THIS SHOULD TELL US SOMETHING CONCERNING THE CRYPTOCURRENCY MARKET IN THIS COUNTRY AND THAT WE SHOULD NOT HAVE SO MUCH FAITH IN THE HEDGE FUNDS PUSHING BITCOINS.

LaVern Isely, Progressive, Overtaxed, Independent Middle Class Taxpayer and Public Citizen Member and USAF Veteran